TV Special

- 50 Billionaires Receive Unnecessary Farm Subsidies – Forbes

- Billionaire governor’s family farms get subsidy – AP

- Billionaires and aristocrats biggest beneficiaries of farm subsidies – The London Economic

- Billionaires Received Millions From Taxpayer Farm Subsidies: Analysis – HuffPost

- Billionaires Received U.S. Farm Subsidies, Report Finds – New York Times

- Column: Rich farmers, not mom-and-pop farms, will collect most of Trump’s tariff bailout – Los Angeles Times

- Farm bill sends taxpayer subsidies to wealthy – Washington Times

- Farm subsidies: A welfare program for agribusiness – The Week

- Farm subsidies: Milking taxpayers – The Economist

- House farm bill seeks to restrict food stamp benefits while allowing subsidies for billionaires – CNN Politics

- Mapping The U.S. Farm Subsidy $1M Club – Forbes

- Meet Your Taxpayer-Subsidized Farm Bill Billionaires! – HuffPost

- Secret Subsidies: Payments to farms allowed to stretch far beyond rural America, sowing concern about who gets what – InvestigateTV

- Taxpayers Turn U.S. Farmers Into Fat Cats With Subsidies – Bloomberg

- The Money Farmers How Oligarchs and Populists Milk the E.U. for Millions – The New York Times

- The Queen, aristocrats and Saudi prince among recipients of EU farm subsidies – The Guardian

- The Queen received 55% boost in EU farming subsidies at Sandringham – Daily Mail Online

- Why do taxpayers subsidize rich farmers – Washington Post

- 50 Billionaires Receive $6.3 Million in Federal Farm Subsidies – EcoWatch

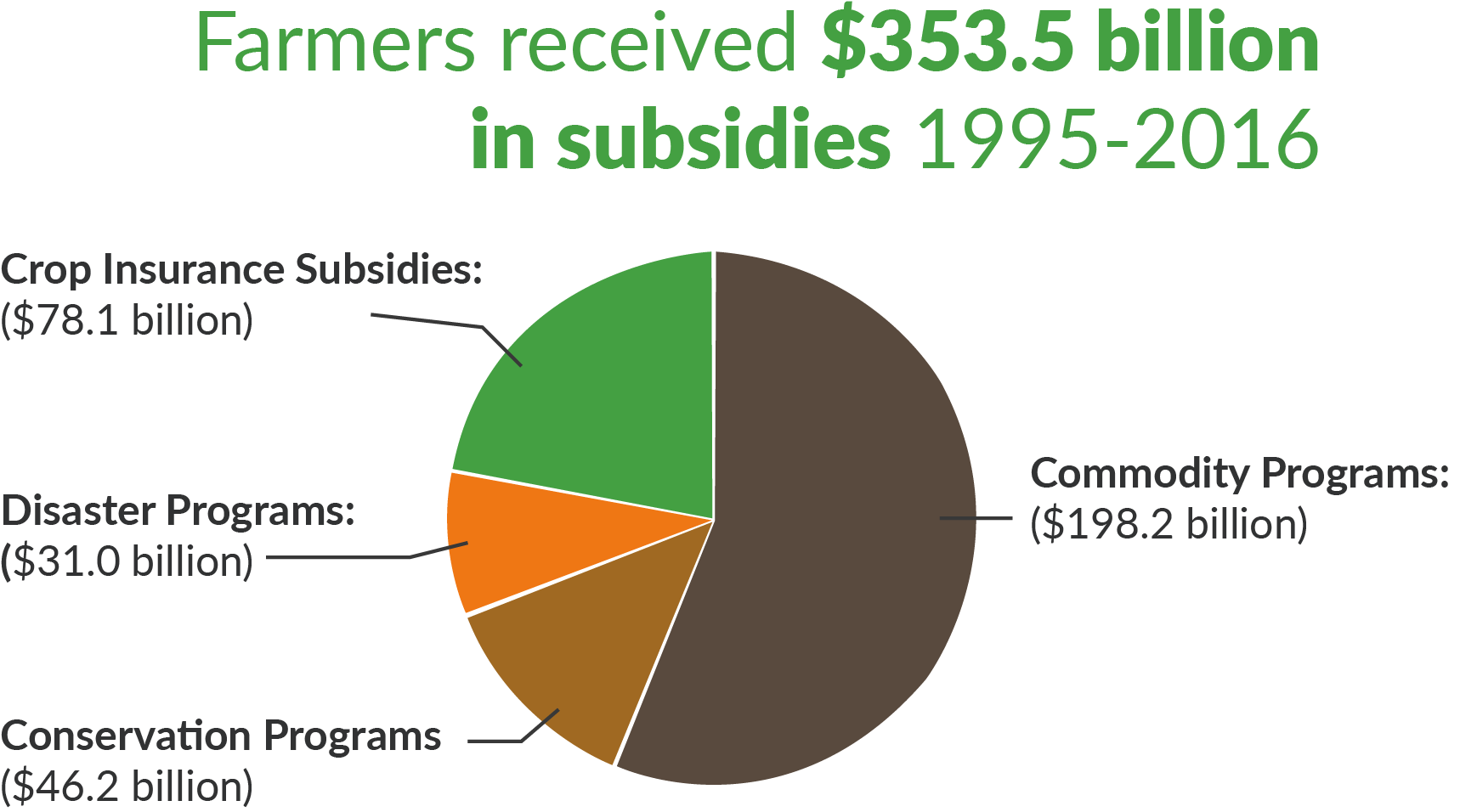

- Agricultural Subsidies – Downsizing the Federal Government

- Agriculture Archives – Taxpayers for Common Sense

- Are Billionaires Getting Crop Insurance Subsidies? We Still Don’t Know – EWG

- Forbes Fat Cats Collect Taxpayer-Funded Farm Subsidies – EWG

- Forbes 400 Subsidy Recipients (1995 – 2012) Forbes Fat Cats Collect Taxpayer-Funded Farm Subsidies EWG

- Fraud and Abuse of Federal Farm Subsidies 2014 – American Cowboy Chronicles

- Harvesting U.S. Farm Subsidies – An OpenTheBooks Oversight Report – Open The Books

- Harvesting U.S. Farm Subsides – Oversight Report by OpenTheBooks.com

- How Farm Subsidies Became America’s Largest Corporate Welfare Program – Heritage Foundation

- Hungarian billionaires receive the most agricultural subsidies in 2014 – The Budapest Beacon

- Meet America’s Elite Farm Subsidy Club – RealClearPolitics

- Rich List billionaires scoop up millions in farm subsidy payments – Unearthed

- The Evil of Agricultural Subsidies- the Case of EU Common Agricultural Policy, Netherlands and New Zealand – IREF

- The Rich Get Richer- 50 Billionaires Got Federal Farm Subsidies – EWG

- USDA Confirms Subsidies Overwhelmingly Flow to Wealthiest Farmers – EWG

- USDA Opening the Treasury to Millionaire “Farmers” – Taxpayers for Common Sense

News

Manhattan “Farmers”

- City-Dwelling Landowners Get Paid Millions Not to Farm Their Secondary Estates – ABC News

- Farm Subsidy Recipients for 32 Straight Years That Currently Reside in the Nation’s 50 Largest Cities – EWG

- Manhattan’s Welfare Kings How Billionaires Turned Farms into Personal Tax Havens and Petty Cash Machines, Allowing Them to Give Less, While Taking More – The Exiled

- Manhattan’s farmers – New York Post

- Manhattan ‘Farmers’ Receive Budget Boondoggle Award – The New York Sun

- Meet the Farmers of Manhattan – EWG

Corn subsidies for high fructose corn syrup

- A brief history of high-fructose corn syrup – EarthSky

- A Sweet Death: The Truth About High Fructose Corn Syrup – Institute for Natural Healing

- Big Business, Soda & Corn Subsidies – High Fructose Corn Syrup

- Farm Subsidies = High-Fructose Corn Syrup = Obesity Or do They – Youtube

- Government subsidies not so sweet for health – Acton Institute

- High Fructose Corn Syrup – Food Conspiracy

- High fructose corn syrup linked to diabetes – USC News

- It’s Time to Rethink America’s Corn System – Scientific American

Sugar Subsidies

- CNN.com – Transcripts

- Did Marco Rubio Hire Big-Sugar Magnate Pepe Fanjul Sr.’s Grandson- – Miami New Times

- High crimes? Or just a sex cover-up? Starr shows all the ways Clinton tried to keep Monica quiet. It’s not Watergate – CNN

- In the Kingdom of Big Sugar – Vanity Fair

- Marco Rubio & Sugar Subsidies: Billionaire Sugar King Donors Influence Policy Stance – National Review

- Meet the Sugar Barons Who Used Both Sides of American Politics to Get Billions in Subsidies – Pro Market

- Palm Beach Sugar Barons Accused in WikiLeaks Cables of Trying to Sabotage U.S. Trade Deal – Forbes

- Rubio’s Deep Sugar Ties Frustrate Conservatives – Bloomberg

- Sweet deal why are these men smiling – The reason is in your sugar bowl – CNN

- The Fanjuls, Sultans of Sugar, and Domino Sugar – AfroCubaWeb

- These Sugar Barons Built an $8 Billion Fortune With Washington’s Help – Bloomberg

- Time to end sugar subsidies and political payoffs – Orlando Sentinel

- Top Five Reasons to End U.S. Sugar Subsidies – Americans for Tax Reform

- Worried About Florida’s Elections- The Fanjuls Aren’t. – Bullsugar.org